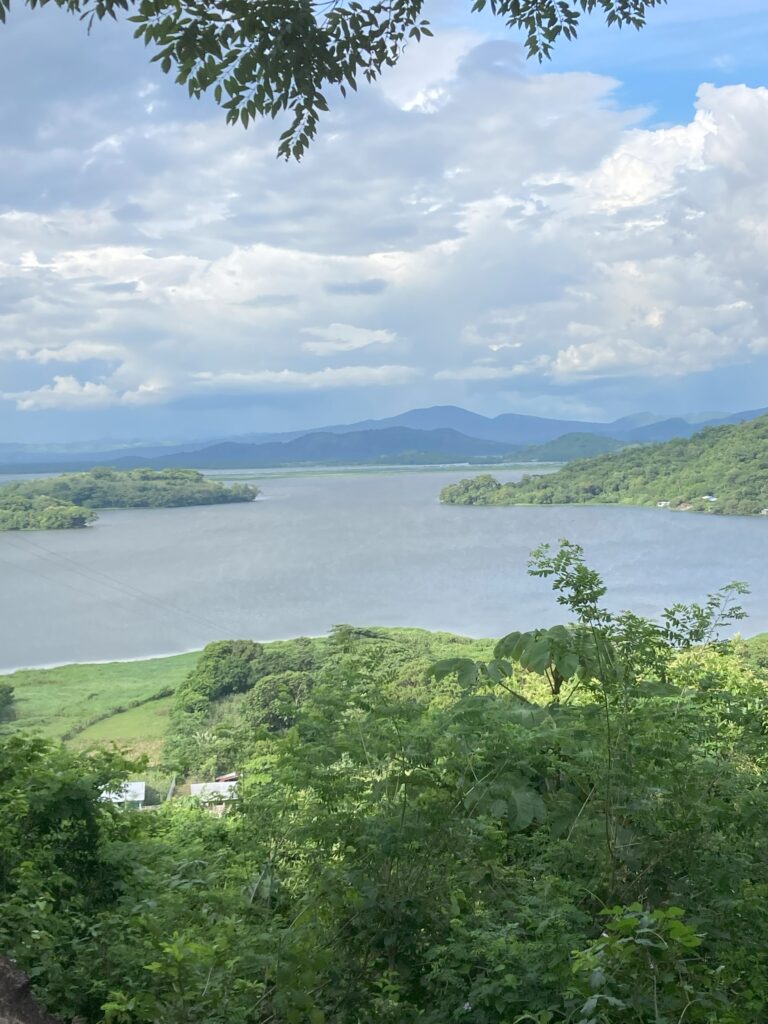

Along the Pacific coast of Mesoamerica, people, plants, and pollinators have shared a bond that goes back thousands of years.

There are three key players at the heart of this story: the farmers who tend the land, the native bees that pollinate it, and the humble squash plants that have nourished families for generations.

These three have always worked in harmony.

The bees visit the squash blossoms at sunrise, helping the plants bear fruit. The farmers care for both the crops and the landscape that keeps the bees thriving.

Over time, this partnership has shaped local agriculture, strengthened communities, and become part of the region’s cultural identity.

But that balance is now changing.

In this blog, we explore why native squash and native bees matter, how they have supported Mesoamerican culture for generations, and what it takes to protect this unique connection.

Native Bees: The Quiet Pollinators of Mesoamerica

Native bees are essential to the health of ecosystems across Central America.

Unlike honeybees, which were introduced from Europe, many native bee species evolved alongside the region’s wild and cultivated plants.

These include stingless bees, solitary bees, and ground-nesting species that thrive in forests, fields, and even backyard gardens.

Native bees differ from honeybees in several important ways:

- They often forage earlier in the morning

- They visit flowers more efficiently

- They show strong preferences for native plants.

Because many native squash species bloom at dawn or in the early hours, local bees are right there when the flowers open.

Their size, behavior, and foraging patterns make them particularly effective pollinators of squash.

This means that for many rural families across this region, these bees are important partners in food production.

Native Squash: A Crop With Deep Roots

Squash has been cultivated in Mesoamerica for more than 8,000 years.

Long before maize and beans rose to cultural prominence, squash was one of the first domesticated crops in the region.

Varieties such as Cucurbita pepo and Cucurbita moschata were grown in home gardens, forest edges, and traditional milpas. These are mixed crop fields that combine maize, beans, and squash.

Squash is valuable for many reasons:

- Its seeds are rich in oil and protein

- Its flesh is nutritious

- Its flowers are central to local cuisine

- The vines protect the soil and reduce evaporation

- They also create a natural ground cover that supports healthy farming systems

But squash cannot thrive without pollinators.

Its flowers open for a few brief hours each morning, and successful fruiting depends on native bees visiting the blossoms during that narrow window.

Without them, harvests can drop dramatically.

The Bond Between the Two

The relationship between squash and native bees is woven deeply into the cultural tapestry of Mesoamerica.

In traditional agriculture, the milpa system placed squash alongside maize and beans.

Each crop supported the others: maize provided structure, beans fixed nitrogen, and squash shaded the soil. Native bees played a crucial role by pollinating squash blossoms.

Indigenous groups understood this connection. Many kept stingless bees, known as meliponas, in hollow logs or clay pots.

The honey was used for medicine, ceremonies, and food. Even today, meliponiculture persists in rural parts of Mexico, Guatemala, and Nicaragua, carrying forward ancient knowledge about pollination and ecological balance.

Local dishes also reflect this heritage. Squash blossoms are used in soups and stews, toasted seeds are ground into sauces, and young squash is served fresh or cooked.

These recipes continue to tie communities to their land and to the pollinators that make the harvest possible.

Why This Relationship Matters Today

The link between native bees and squash remains essential to food security and rural livelihoods. Many families still grow squash for household use, market sales, or seed saving.

Healthy bee populations help sustain these crops without the need for chemical inputs.

But both native bees and traditional squash varieties are facing growing threats, such as:

Declines in native bee populations

Native bees are sensitive to changes in land use.

Clearing forests, burning fields, and replacing mixed crops with monocultures reduces the habitat they rely on.

Pesticides add additional pressure by reducing insect numbers and contaminating flowers.

Loss of traditional agricultural systems

As modern farming expands, traditional milpas and home gardens become less common. Fewer squash varieties are planted, which means there are fewer flowers for native bees.

This loss of agricultural diversity affects food systems and cultural heritage alike.

Climate pressure

Warmer temperatures and unpredictable rain affect bloom timing.

If squash flowers open earlier or later, native bees may not arrive at the right moment, reducing fruit set.

The Role of Conservation

Protecting native bees and native squash is essential not only for biodiversity but also for food security, traditional farming, and the livelihoods of rural communities that depend on these crops.

Here are some practical steps toward this goal:

Encouraging native plant gardens

When farmers and families grow native squash and other local crops, they create living spaces for native bees.

These gardens become small sanctuaries where pollinators can feed and nest safely.

They also help keep traditional farming varieties alive, linking present-day practices to generations of cultural wisdom.

Supporting pesticide-free agriculture

Native bees are highly sensitive to chemicals.

Encouraging organic or low-impact farming protects pollinators while improving soil and water health can help greatly.

Many farmers who move toward pesticide-free methods notice more bee activity and better pollination.

Restoring natural habitats

Habitat restoration is one of the strongest tools for recovery.

Reforestation, mangrove protection, and sustainable land management give bees food sources throughout the year and safe sites for nesting.

These efforts also benefit other wildlife and strengthen the ecosystems that rural communities rely on for farming, fishing, and daily life.

Sharing knowledge

Traditional knowledge is a cornerstone of conservation.

Practices such as meliponiculture and seed saving preserve both biodiversity and cultural heritage.

When communities share what they know, whether it’s how to care for bees or how to grow native squash, they ensure that ancient wisdom continues to guide sustainable living today.

Help Paso Pacifico Keep the Connection Alive

The story of native bees and native squash is, at its heart, a story about balance.

A balance between:

- People

- The land

- Tradition and change

- Cultivation

- Care

For thousands of years, this connection has helped communities across Mesoamerica thrive. It has shaped what people grow and eat, as well as how they live in harmony with nature.

Today, that balance needs our attention.

By supporting local farmers, planting native crops, protecting wild habitats, and valuing traditional knowledge, we can help ensure that these quiet pollinators and ancient crops continue to flourish side by side.

At Paso Pacífico, this belief guides our work.

We’re committed to protecting the relationships that sustain life along the Pacific coast. Our work encompasses everything from restoring native vegetation, helping to protect different species, to empowering rural communities.

You, too, can be part of that effort by learning, sharing, volunteering, or supporting conservation projects that keep this heritage alive.

Together, we can make sure that the hum of bees in the morning and the golden bloom of squash in the fields remain a part of Mesoamerica’s living story.